President-elect Donald Trump has picked hedge fund government Scott Bessent because the U.S. Treasury Secretary.

What Occurred: Bessent, 62 and founding father of Key Sq. Group, was a number one candidate, competing with former Fed Governor Kevin Warsh and personal fairness government Marc Rowan.

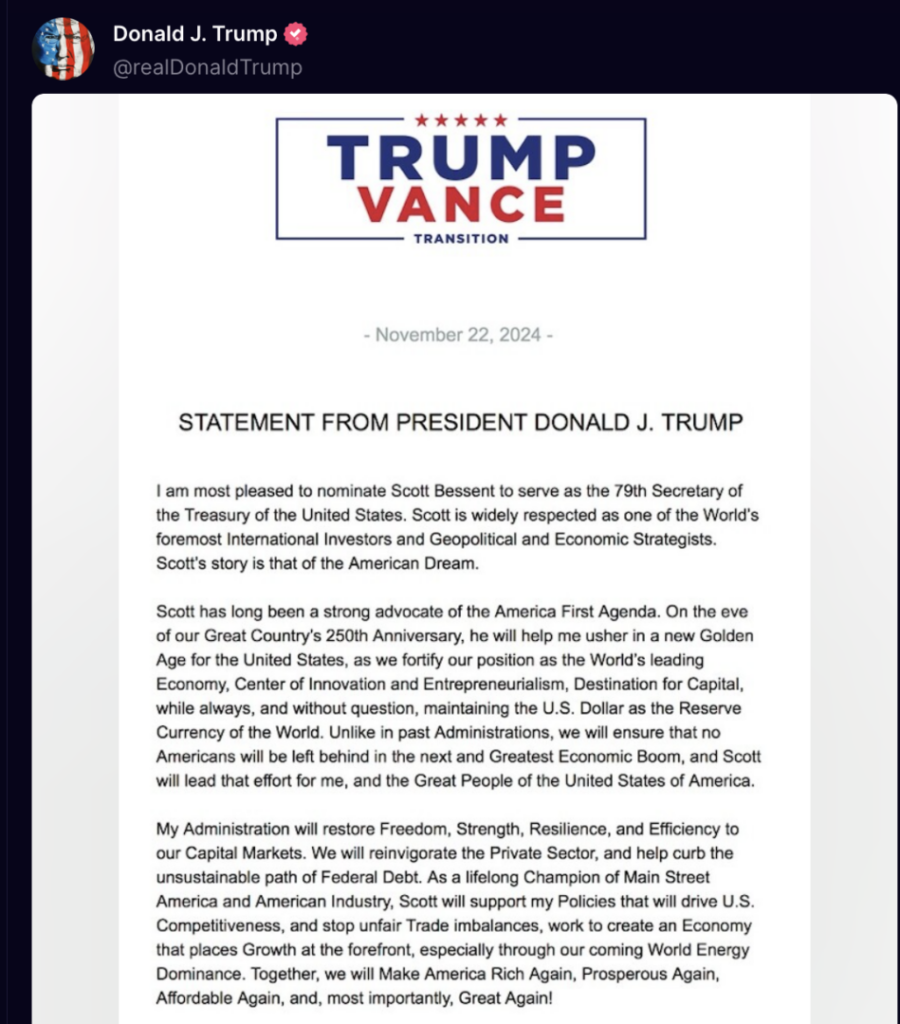

Whereas sharing the choice on Friday by way of his social media platform Fact Social, Trump lauded Bessent as “one of many World’s foremost Worldwide Traders and Geopolitical and Financial Strategists.”

See Additionally: Trump’s Hush Cash Sentencing Delayed As Authorized Immunity Debate Escalates

Bessent is understood for his help of gradual tariffs and deregulation, aligning with Trump’s financial imaginative and prescient, which incorporates reviving manufacturing and reaching vitality independence.

Regardless of his earlier function as chief funding officer for George Soros’ fund, Trump expressed confidence in Bessent’s capacity to enhance U.S. competitiveness and handle commerce imbalances.

Why It Issues: As Treasury Secretary, Bessent will change outgoing Secretary Janet Yellen, overseeing monetary establishments and combating monetary crimes at a time when the nationwide debt has ballooned to $36 trillion.

In line with betting markets, Bessent was a frontrunner with an 82% chance of securing the nomination. His appointment may considerably impression Wall Avenue and the crypto sector.

In October, Bessent assured {that a} new Trump administration would help a robust greenback, countering earlier solutions of a weaker greenback to spice up exports.

Regardless of Elon Musk’s help for Howard Lutnick, Trump favored Bessent’s business-as-usual method.

In July, Bessent gained consideration for his optimistic stance on cryptocurrency, suggesting he would possibly help digital belongings if confirmed. “Crypto is about freedom and the crypto financial system is right here to remain,” he acknowledged on the time.

The most recent 13F submitting from Bessent’s Key Sq. Group fund exhibits a extremely concentrated portfolio, with equal investments in two banking-focused ETFs: the SPDR S&P Regional Banking ETF KRE and the SPDR S&P Financial institution ETF KBE, every making up 50% of the fund.

Learn Subsequent:

Disclaimer: This content material was partially produced with the assistance of Benzinga Neuro and was reviewed and revealed by Benzinga editors.

Photograph courtesy: Shutterstock

Market Information and Information dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.