Activist fund Elliott Administration has made a number of strikes in 2024 together with focusing on espresso chain Starbucks Company SBUX, which not too long ago introduced a brand new CEO.

A brand new 13F submitting reveals three different key areas Elliott is growing concentrate on.

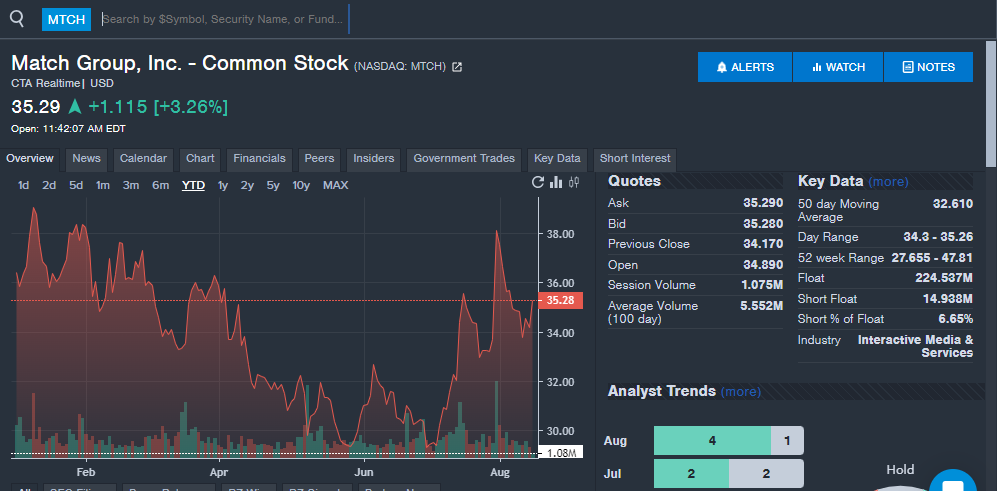

Match Group: On-line courting firm Match Group Inc MTCH is without doubt one of the shares that noticed an elevated place from Elliott in a brand new 13F submitting.

Elliott Administration owns 11,705,013 shares of Match Group, up 184% from a earlier whole of 4.125 million shares. The elevated stake comes as activist hedge fund Starboard Worth has acquired a reported 6.5% stake and is pushing for adjustments.

Starboard is pushing Match Group to increase its margins or think about a sale of the corporate. The hedge fund highlighted the power of the Tinder and Hinge manufacturers in its feedback on the corporate.

Elliott Administration took a stake within the firm earlier this yr and can also be stated to be pushing for adjustments.

Final month, Match Group reported second-quarter monetary outcomes, with income exceeding analyst estimates and earnings per share assembly expectations.

Match Group shares are down 3.6% year-to-date in 2024, as seen on the Benzinga Professional chart beneath. Match shares commerce at $35.18 versus a 52-week buying and selling vary of $27.66 to $47.81.

Learn Additionally: Benzinga’s ‘Inventory Whisper’ Index: 5 Shares Traders Secretly Monitor However Don’t Discuss About But

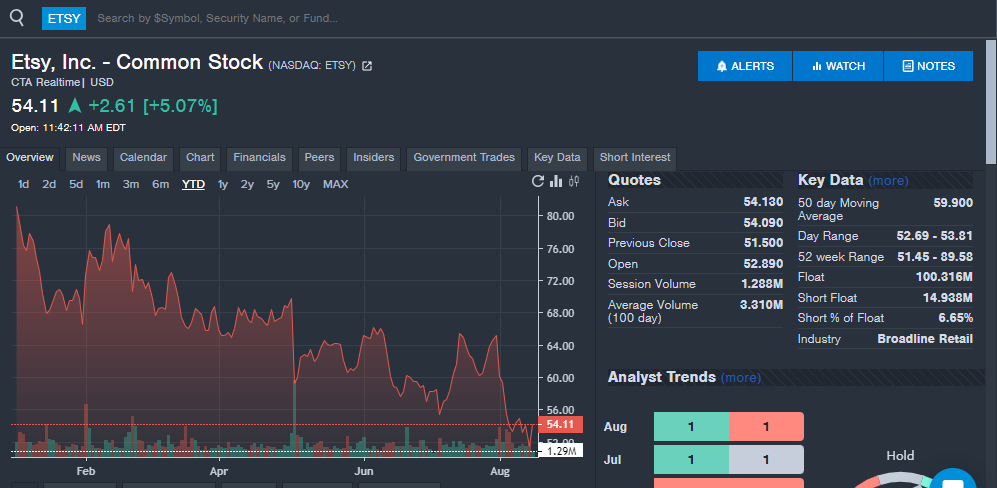

Etsy Stake: Elliott Administration doubled a stake in ecommerce firm Etsy Inc ETSY within the second quarter. The fund now owns 4,500,000 shares, up from 2,250,000 shares owned beforehand.

Elliott’s senior portfolio supervisor Marc Steinberg was added to the Etsy board of administrators earlier this yr because the activist investor pushes for adjustments after underperformance.

“Etsy has a extremely differentiated place within the e-commerce panorama and a uniquely enticing enterprise mannequin, supported by a particular and engaged neighborhood. We turned a large investor in Etsy and I’m becoming a member of its board as a result of I imagine there is a chance for vital worth creation,” Steinberg stated on the time.

Etsy not too long ago beat second-quarter income and earnings per share estimates from analysts and stated the copay is making progress on “daring strikes.” Energetic consumers have been up 1% year-over-year within the second quarter.

Etsy shares are down 33.3% year-to-date, as seen on the Benzinga Professional chart beneath. Etsy shares commerce at $54.03 versus a 52-week buying and selling vary of $51.45 to $89.58.

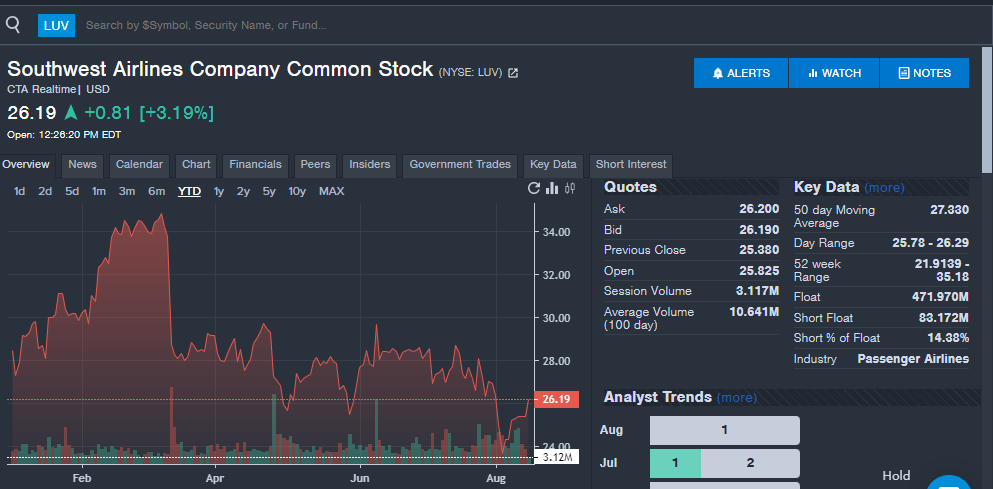

Airline Shares: Elliott Administration has made latest headlines for his or her stake in airline firm Southwest Airways Firm LUV and pushing for adjustments to the corporate’s board of administrators.

The 13F submitting revealed extra purchases of shares of Southwest Airways, bringing the whole possession to 48,948,500 shares, as indicated in a 13D submitting.

Elliott plans to appoint 10 unbiased candidates for Southwest’s board within the ongoing activist battle. Elliott is pushing for a change to the board, new management and a enterprise overview to spice up the underperforming inventory.

Southwest and Elliott have agreed to a gathering in September to debate a decision to their battle in opposition to each other. The airline firm additionally has an Investor Day deliberate for late September that might supply extra perception into its plans to turnaround the corporate.

The Elliott 13F submitting additionally revealed U.S. World Jets ETF JETS places owned, with a place representing 9,500,000 shares growing 660% over the past quarter. Southwest is the most important weighting within the ETF representing 10.4% of property, which might make the put a hedge in opposition to the Southwest stake or a perception that your complete airline sector might underperform.

The submitting additionally confirmed 11.5 million shares of American Airways Group AAL represented by places, doubtlessly betting in opposition to one of many largest airways and Southwest rivals.

Southwest Airways inventory is down 9.4% year-to-date in 2024, as seen on the Benzinga Professional chart beneath. Southwest shares commerce at $26.17 versus a 52-week buying and selling vary of $21.91 to $35.18.

Learn Subsequent:

Picture created utilizing synthetic intelligence by way of Midjourney.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.