Why Hidden Debt Issues

Traders usually give attention to primary monetary figures, however it’s important to think about hidden debt when evaluating an organization’s true price.

Insights from Viridian Capital Advisors reveal that missed liabilities can considerably change how we view an organization’s worth, making it essential to dig deeper.

- Get Benzinga’s unique evaluation and the highest information in regards to the hashish trade and markets each day in your inbox without spending a dime. Subscribe to our e-newsletter right here. You possibly can’t afford to overlook out in the event you’re severe in regards to the enterprise.

Viridian’s Method To Valuation

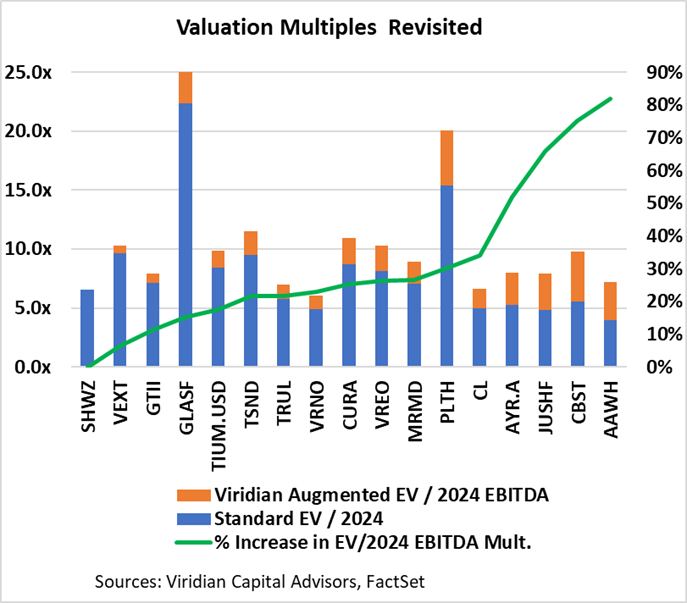

Sometimes, enterprise worth (EV) is calculated utilizing customary strategies. Nonetheless, Viridian takes a extra thorough method by together with lease obligations and overdue tax funds.

In addition they think about long-term tax liabilities that corporations have but to handle. This leads to a better debt determine and results in revised calculations that present corporations could also be extra beneficial than initially thought.

The Affect On Investor Choices

A latest graph compares conventional valuation strategies with Viridian’s up to date figures. Corporations that appeared low cost could also be much less undervalued than beforehand believed, significantly these burdened by vital lease or tax liabilities.

Market Notion of Undervalued Hashish Shares

Corporations like Planet 13 Holdings PLNH and MariMed MRMD, which initially appeared undervalued primarily based on conventional EV/EBITDA multiples, noticed vital valuation will increase when Viridian Capital’s augmented EV calculations factored in hidden debt. This reveals that traders who overlook these liabilities may mistakenly view these corporations as extra enticing investments than they honestly are.

Affect of Debt on Investor Sentiment

In distinction, corporations similar to Schwazze SHWZ, Vext Science VEXTF, and Inexperienced Thumb Industries GTII present minimal modifications in valuation, suggesting cleaner steadiness sheets that might strengthen investor confidence.

Learn Subsequent: 5 Causes Why Decrease Curiosity Charges Might Increase The Hashish Business

Market Information and Knowledge dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Click on on the picture for more information.

Hashish rescheduling appears to be proper across the nook

Need to perceive what this implies for the way forward for the trade?

Hear immediately for high executives, traders and policymakers on the Benzinga Hashish Capital Convention, coming to Chicago this Oct. 8-9.

Get your tickets now earlier than costs surge by following this hyperlink.