Are you struggling to maintain your small business funds organized and on observe? You’re definitely not the one one going through this problem. Many entrepreneurs discover themselves overwhelmed by the complexities of monetary administration, typically wishing that they had a trusted advisor to information them. A digital CFO can present strategic insights and help will help you with this.

On this weblog, we’ll discover seven key advantages of hiring a digital CFO, displaying you ways this progressive answer can streamline your monetary processes and assist your small business thrive. Able to unlock the potential of your funds? Let’s dive in!

Who’s a Digital CFO?

A digital chief monetary officer, or VCFO, is an knowledgeable offering high-level monetary technique and administration providers remotely. This contemporary innovation provides the enterprise the experience of a seasoned CFO with out having to bear the overhead price of a full-time govt. Sometimes part-timer, typically on a undertaking or retainer foundation, a VCFO carefully resembles a standard CFO however affords the enterprise nice flexibility.

Due to this fact, hiring a digital CFO can be a superb alternative for any enterprise to optimize its monetary operations. These digital cfo providers deliver expertise and specialised information to the desk that enables firms to navigate advanced monetary landscapes with agility and precision.

Why Does a Enterprise Want a Digital CFO?

A enterprise wants a digital CFO to get knowledgeable monetary assist at a decrease price than hiring a full-time CFO. The digital cfo service supplies flexibility to adapt to enterprise wants and produce alongside worthwhile insights into different industries for a greater monetary technique.

Outsourcing monetary administration offers enterprise homeowners time to give attention to core companies whereas being helped by good monetary planning, threat administration, and money move dealing with. This ensures that the rules are met, protecting the enterprise out of monetary issues, and attaining more healthy and higher monetary standing and development.

1. Enhanced Monetary Technique Growth

A profitable monetary technique is the spine of your group, and a VCFO service can offer you a monetary plan that’s personalized in keeping with your small business targets and prevailing market situations. Digital CFOs align themselves together with your management group to make sure monetary methods are consistent with enterprise aims and promote sustainable development.

Your small business shall be extra ready to adapt to adjustments available in the market by way of huge industrial publicity by your digital CFO. In addition they use superior modeling methods for state of affairs planning, serving to organizations anticipate monetary challenges and put together various actions to make sure operations proceed regardless of financial adjustments.

2. Value-Efficient Monetary Administration

Each greenback saved is a greenback earned, making cost-effective monetary administration essential at this time. Digital CFOs provide:

- Value-effective providers in comparison with a standard CFO as they get rid of price advantages and workplace house.

- Supply versatile plans which let you pay just for what you want.

- Entry to high-level expertise and business insights and not using a full-time wage.

This environment friendly administration enhances higher selections and improves your efficiency within the monetary sense.

3. Improved Money Stream Administration

Money move is a vital side of enterprise stability, and digital CFO providers improve administration with real-time monitoring and optimization of money move processes. Digital CFOs observe money move utilizing superior instruments, which makes it attainable to detect potential issues or weaknesses and undertake corrective actions on time.

In addition they streamline invoicing to hurry up money inflows and develop methods that cut back late funds and unhealthy money owed, enhancing the money move.

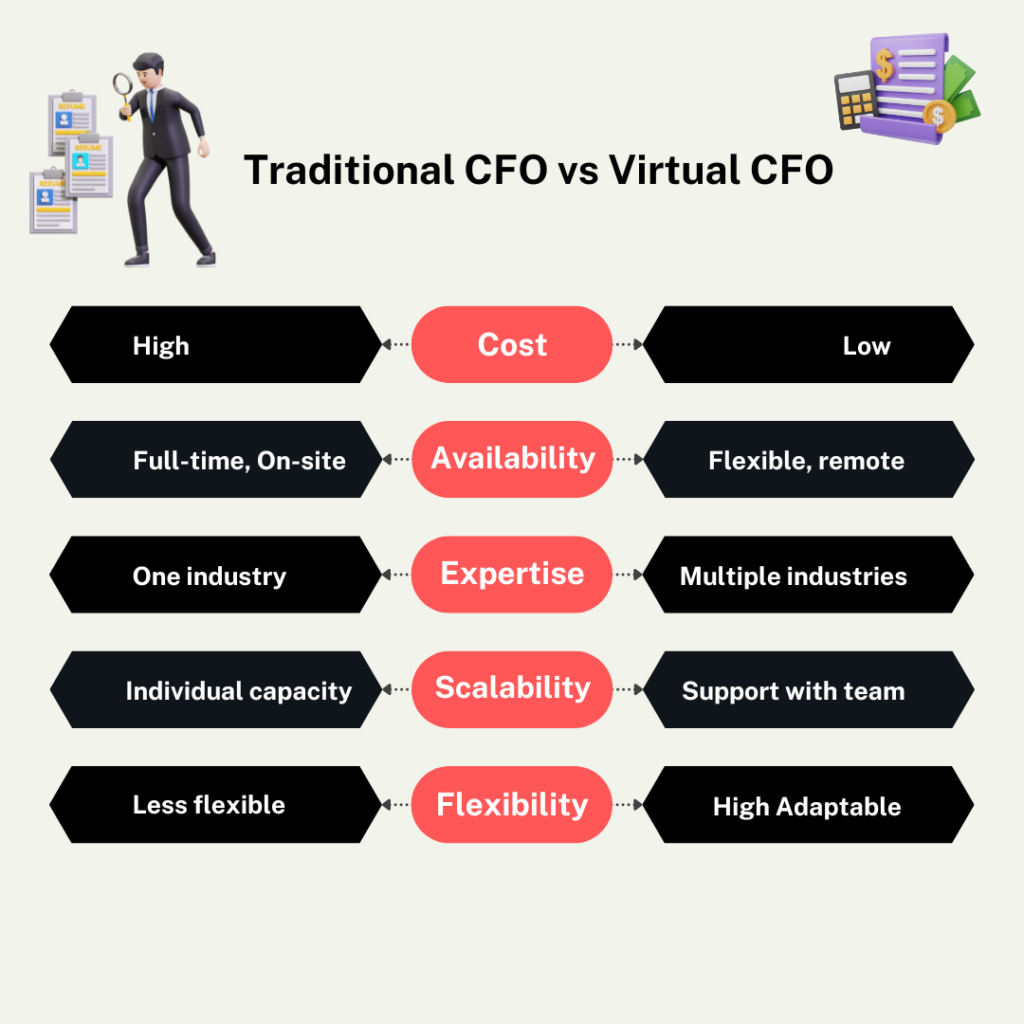

To reply your query higher, right here’s a comparability between conventional and digital CFO providers:

From the above comparability, we will say that digital CFO providers are extra versatile and cost-effective. Thus, digital CFO providers come to serve companies seeking to optimize their monetary administration.

4. Monetary Reporting

Related information can be utilized to arrange clear monetary reviews, and digital CFOs are one of the best at making these insightful paperwork. They determine and observe key efficiency indicators tailor-made to your small business, making it simpler to evaluate monetary well being. Superior information visualization methods simplify advanced data, permitting the administration to expedite decision-making.

Digital CFOs additionally examine monetary setups periodically, make vital changes to methods, and observe whether or not or not your small business stays in step with monetary rules which take away dangers and fix sure penalties to it.

5. Strategic Steering and Enterprise Development

Strategic steering from Digital CFOs:

- Supply strategic recommendation on enterprise enlargement alternatives.

- Analyze market situations and apply business information to find out promising investments.

- Present knowledgeable suggestions on useful resource allocation to make sure the best development potential.

Digital CFOs assist companies in mergers and acquisitions by conducting appropriate targets by way of monetary evaluation and recommending deal structuring to attenuate worth destruction and take dangers successfully.

6. Streamlined Monetary Processes

Streamlining monetary processes with the assistance of digital CFOs can result in vital time and price financial savings. They undertake trendy, and tailor-made monetary software program that will increase operational effectivity and frees up sources by way of automation of repetitive actions, which reduces the probabilities of errors. Digital CFOs permit finance and different departments to speak on behalf of groups to align monetary aims with broader group targets, which improves total enterprise effectivity.

7. Professional Compliance and Threat Mitigation

Digital CFOs have excellent compliance and threat mitigation in regulatory environments. They guarantee your small business has correct tax filings, keep up to date on adjustments in tax legal guidelines, shield your small business from most penalties, and enable you to determine tax-saving alternatives to maximise the potential of your deductions. Digital CFOs additionally set up and keep a robust set of inside controls that shield the integrity of your group at common intervals. In addition they present security to your small business by constructing resilience to any monetary dangers and vulnerabilities.

Conclusion

Among the advantages that accrue from the adoption of a digital CFO embrace higher monetary methods and compliance experience. With digital CFO providers, companies can draw world-class monetary experience with out the associated fee burden of a full-time govt. Digital CFO providers provide versatile cost-effectiveness and unparalleled strategic perception into up to date monetary administration.

Think about the potential development and effectivity a digital CFO can deliver to your small business. In an period the place agility and experience are key to success, partnering with a digital CFO could possibly be the strategic transfer that propels your small business to new heights of monetary efficiency and stability.

Often Requested Questions (FAQs)

- What providers does a digital CFO present?

A digital CFO provides a spread of providers, together with monetary technique improvement, money move administration, monetary reporting, tax planning and compliance, and threat administration. The digital CFO service is designed to fulfill the particular necessities of your small business.

- How does hiring a digital CFO profit my enterprise?

A digital CFO represents one of the accessible methods to have top-level monetary capabilities accessible to help with strengthening monetary selections, enhancing money move, recognizing development alternatives, and offering rule-of-law compliance for a profitable enterprise.

- What industries can profit from digital CFO providers?

Digital CFO providers profit the industries of startups, small and medium-sized enterprises, e-commerce, and even non-profit organizations. Any enterprise that wants finance steering and help can simply leverage the information or perception of a digital CFO.